Financials

THREE YEARS INTO the implementation of our 10-year strategic plan, DU IMPACT 2025, the University of Denver has accelerated efforts to refine the student experience, generate new knowledge, invigorate the community outside campus, and build bridges between DU and the world at large.

These efforts are enhanced by vigilant stewardship of fiscal and human resources and strategically calibrated fundraising efforts targeted at supporting the institution’s long-term vision and fiscal health. Just as important, the University adheres to budget policies designed to optimize revenues and reserves. Over the last five years, we have channeled $36 million from our operating margin to a strategic planning reserve.

Marking the 29th consecutive year of positive operations, the University of Denver concluded the 2018 fiscal year on June 30, with total operating revenues of $459.5 million, an increase of $16.9 million from the prior year. In Fiscal Year 2018, the University realized a 6.8 percent operating margin of $31.4 million.

This strong margin allowed the University to boost our investment in student-focused priorities, raising, for example, the amount we channeled into instruction by $6.6 million to $162.9 million.

The University recorded a net asset base of $1.4 billion in Fiscal Year 2018. This represented a year-over-year increase of $62.4 million. The institution’s endowment, meanwhile, grew from $711.3 million in 2017 to $762 million at the close of the fiscal year. Growth came primarily from investment gains of $60.3 million and new gifts of $17.6 million. A release of $33.8 million from the endowment was directed to operations primarily for financial aid and professorships.

Although the endowment has grown steadily in recent years, it remains insufficient to fuel the University’s aspirations, propel our focus on offering an unparalleled student experience and support the financial aid needs of our students. The University’s endowment per student lags significantly behind both the median and average among our peer institutions, registering at just $56,201.* Among our peers, the average endowment per student is $96,945, and the median is $83,361 (as of June 30, 2017). In other words, many of the University’s competitors are able to supplement their revenue streams with generous releases from the endowment, which affords them a formidable advantage in an ever-more-challenging student-recruitment environment.

Because the University remains reliant on tuition for a large percentage of its total unrestricted operating revenue (65 percent in Fiscal Year 2018, down from 67 percent in 2017), building the endowment will remain a University priority for years to come. A more robust endowment is essential if the University is to expand need-based aid and thus our ability to attract and retain the most promising undergraduate and graduate students from all backgrounds.

An expanded endowment and an engaged donor base are also essential for funding the enriched environment that 21st-century students need to prepare for an uncertain and sure-to-be-challenging future. With their promising careers and lives as responsible citizens in mind, the University has leveraged its A1 credit rating from Moody’s Investor Service to borrow $157.6 million for construction of three new student-focused buildings. In addition, the University’s Denver Advantage Campus Framework Plan calls for numerous enhancements to campus in the coming year, many of them intended to elevate the student experience and invigorate academic pursuits in professional psychology, social work and the STEM disciplines (science, technology, engineering and mathematics).

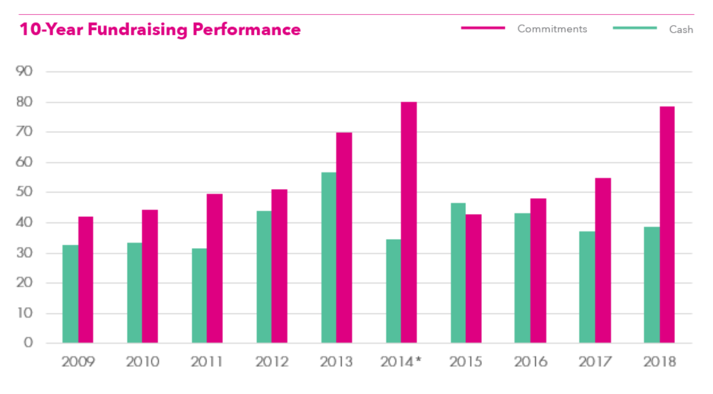

In Fiscal Year 2018, fundraising efforts generated $78.6 million in private support from alumni, parents, friends, foundations and corporations. This represents an increase from $55 million in the previous year.

This $23 million boost in funds raised results from a robust advancement enterprise tasked with developing and leading a forthcoming comprehensive campaign. Thanks to the sustained generosity of DU’s donor community and friends, the institution is increasingly well-positioned to advance its goals.

* in the most current IPEDS peer comparison data available through nces.ed.gov/ipeds/

Amounts reported here are not reflected in the University’s audited financial statements. These sums include gifts made via testamentary intentions, conditional pledge agreements and gifts in kind.

*2014 marked the conclusion of the ASCEND fundraising campaign